The largest trade body of Scottish distilleries is asking the UK government abandon a new tax on spirits.

Since 1987, the price of whisky has risen from 67p per ‘nip’ to £3.72, an increase of over 450%.

Data from the ONS has shown that in the last year alone, the average price of a nip jumped over 30% from £2.85 at the start of 2022 to £3.72 by March 2023.

The recent price jump has come in response to a tax hike that was for distilleries in the chancellor’s Spring budget.

From August, UK distilleries producing gin, whisky or any other spirit will be set to pay an increased 10.1% tax duty on each bottle, meaning 75% of the total value of every bottle produced will now be recouped in tax.

The tax increase is the freshest in a slew of blows for distilleries since the 2019 general election, where the government made pledges to better support whisky distilleries and the already inflated taxes they faced.

Since then, distilleries’ tax burdens have increased from 70% to 75% on the average bottle – despite tax breaks given to draught products – and have been excluded from energy relief schemes.

The Scotch Whisky Association, a trade organisation which represents the Scotch whisky industry, has in reaction to this launched a new campaign called ‘Keep the Commitment’ to ask that the government returns to their pledges, provide energy relief schemes to distilleries, and abandon the proposed tax which has already begun to show its drastic effects on the UK spirits market.

Graeme Littlejohn, Director of Strategy at the SWA, said: “The UK government promised to ensure the tax system was supporting the industry, but the planned duty hike will widen the competitive disadvantage faced by distillers in relation to other alcoholic products.

“It will limit the ability of the industry to invest in communities across Scotland and the UK supply chain, and have a knock-on inflationary impact on consumers – something we are already seeing in this ONS data.”

In the Queen’s Speech that followed the 2019 General Election, the UK government had promised to “review alcohol duty to ensure our tax system is supporting Scottish whisky and gin producers and protecting 42,000 jobs supported by Scotch across the UK.”

Littlejohn added: “The SWA will continue to campaign for greater fairness for Scotland’s national drink through the tax system, pressing the government to keep the commitment it has made to the industry.”

Humza Yousaf, the Scottish First Minister, challenged Rishi Sunak on the tax ahead of the pair’s first face-to-face meeting this week at the Scottish Conservative Conference.

Regarding the tax, the prime minister told the BBC: “The Chancellor makes all tax decisions, and that decision has been made.”

“Whisky duty is at the lowest level it has been at in real terms in about 100 years, as well as the fact we have been able to open up export markets around the world for fantastic Scotch whisky.”

The prime minister’s comments come days after the private meeting between the two leaders – following which a spokesperson said Yousaf was “pleased that the prime minister committed to fairness in how the Scotch whisky industry is treated by the UK Government.”

Continuing to speak on behalf of the first minister, the spokesperson added: “He now needs to deliver on that.”

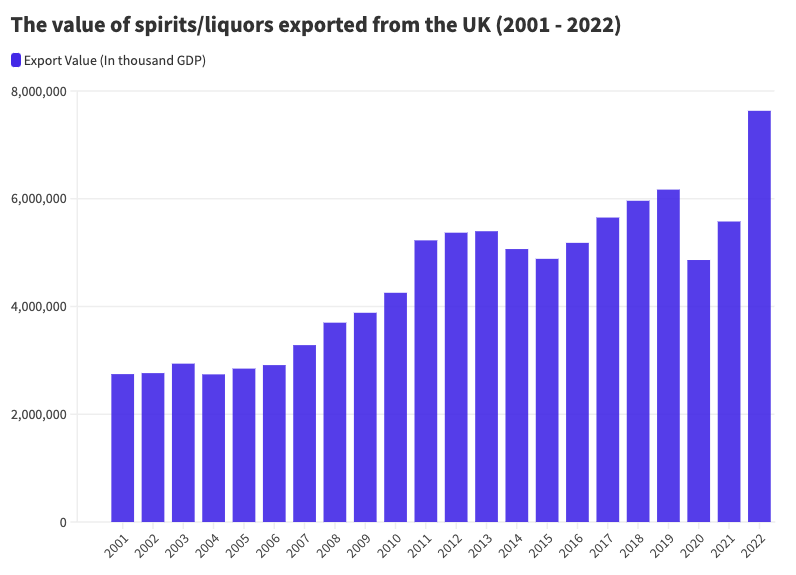

The UK is the biggest spirits exporter in the world, a fact that is almost entirely due to the heritage gin and whisky companies that make up the UK’s domestic spirit production. In 2022, Scotch alone made up 25% of all UK food and drink exports.

Brands such as Johnnie Walker, Macallan, Chivas Regal and Glendfiddich are the favourites of customers in the United States, who represent the largest global export destination for UK whisky.

These brands are all sold as Scotches, which can only ever be distilled in Scotland due to a strict law that defines Scotch by its point of origin.

For more information on the Scotch Whisky Association’s ‘Keep the Commitment’ campaign, visit its website here.

Join the discussion